Categories

EntroPay’s Virtual Visa Car explained

6 minute read

Everyone purchases goods and services online however sometimes you do business with companies that you have never heard of, or companies whose websites have crude user interfaces that make you question their security protocols, or businesses located overseas in somewhat dodgy countries. Other times, people want to buy ‘private’ items where you do not want an audit trail linking your personal details as the buyer. In the vast majority of these cases, you often need to pay by credit card as PayPal is not available as a payment option.

This is where virtual Visa cards come in handy. Whatever the risk that concerns you, you can set up anonymous virtual Visa cards to make your transaction or series of transactions, and you can top up the appropriate amount of prepaid credit. The benefits of this payment option are huge with reduced risk of fraud, greater control of the available credit on a particular virtual card, and higher online anonymity. Virtual Visa cards may seem like a niche payment method right now but it allows you to be both smarter and safer online, which should lead to higher adoption of this online payment method over the long term.

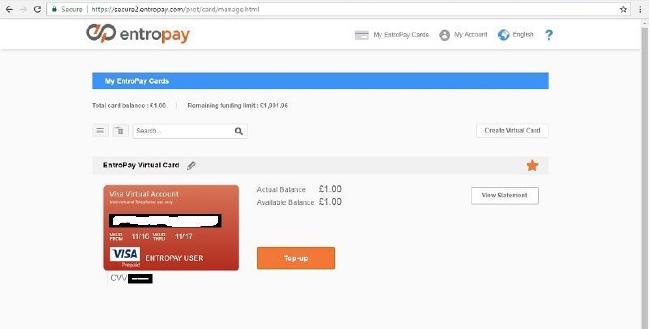

Source: entropay.com

What Is the EntroPay Virtual Visa Card? How Does It Work?

EntroPay was the first European virtual Visa card which was made available in 2003. Since then, it has loaded over £1bn of funds and created over 6m virtual credit cards. If you sign up to an EntroPay account, you will need to provide your personal details and set up a funding source (debit or credit card or bank account transfer). After you set up your username and password and load your funds, you can start making online purchases. One of the best features of EntroPay is that you can set up multiple virtual Visa cards for different uses as well as in different currencies (£, $, €). In terms of managing your various virtual card(s), you can add new cards and delete existing cards in one click.

There is minimum top up amounts of £10 and maximum top up amounts of £1,000 per transaction, however, you can top up to a cumulative total of £10,000 each month. Top ups can be made either by debit card, credit card or bank transfer. As EntroPay cards are prepaid, there are no interest charges, no monthly or annual fees, and spending is limited to the amount of prepaid credit loaded onto the card. Also, virtual cards are not tied to a bank account.

In order to make online purchases, you can use your EntroPay card anywhere Visa is accepted online. With an EntroPay transaction, you provide your virtual card number, expiry date and security CVV code which are known only to you. As stated above, neither your personal information nor credit card details are given to merchants when you make an online purchase. Also, each time you make a transaction, you can use a different virtual card. Similar to a regular credit card, your purchases show up on your EntroPay transaction history with a slight delay (not real time).

entropay_signup.jpg" alt=“EntroPay Sign Up page”>}}** Source: entropay.com

What Are The Advantages of Using An EntroPay Virtual Visa Card?

Some of the key advantages of EntroPay’s virtual Visa cards include:

- You can set up virtual Visa cards in multiple currencies: GBP £, USD $ or Euro €

- You can set up a virtual Visa card to make one single transaction then delete it afterwards

- You can set up multiple virtual Visa cards for different uses

- You can set up new virtual Visa cards or delete existing cards in a single click

- You can set the credit limit of each virtual Visa card by topping up the appropriate amount of prepaid credit

- Virtual Visa cards are accepted online anywhere where Visa is accepted as a payment method

- You can reduce your risk of fraud by using a virtual Visa card

- You can protect your anonymity online by using a Virtual Visa card

What Is EntroPay’s Business Model?

EntroPay’s business model is based on charging transaction fees similar to other credit card providers. Basic services such as signing up, setting up cards, making online purchases are free however fees are charged for other services such as foreign currency transactions and loading funds on to a virtual card. There are no ongoing monthly or annual fees for maintaining your virtual card(s) and no interest charges as EntroPay’s cards are prepaid. The most common EntroPay fees include:

- 2% foreign exchange fees on purchases

- £0.10 card to card transfer

- Up to 1.95% fees funding by 3rd parties

- 4.95% loading funds fees from a credit / debit card

- 3.95% loading funds fees from a personal bank account

What Is The Story Behind EntroPay?

EntroPay is owned by Ixaris Systems Ltd, a financial services company based in London that is authorized and regulated by the UK’s FCA (financial services regulator). In 2000, the company recognized a need for sending and receiving secure online payments and three years later, it established the EntroPay virtual prepaid credit card. EntroPay was the first European virtual prepaid credit card and it was revolutionary in that it could be accepted anywhere Visa or Mastercard payments were accepted online or over the phone. Now EntroPay is widely accepted by millions of merchants globally.

Personal Opinion

I stumbled across EntroPay last year when I was given their virtual Visa credit card as a gift. At first, I did not understand the purpose of a virtual credit card however, once I thought about it, I realized the bigger picture and its many advantages. In terms of online payments, I often prefer to make purchases with PayPal instead of credit cards, especially with people and companies that I am unfamiliar with. Like most people, I am also concerned with debit and credit card fraud especially online and I do not even like to provide personal details online to make any sort of purchase or booking. As a result, I see huge potential for virtual credit cards to reduce fraud and protect your online anonymity, which is something that I believe more people will start to focus on in the near future as greater percentages of our purchases go online.

Feedback From The giffgaff Community

Have you ever heard of virtual Visa cards before? How do you typically pay for goods and services online? Would you feel ‘safer’ using a virtual visa card instead of your regular credit card?

Thanks for reading!